How can manufacturing businesses boost their chances of securing growth capital? We’ve invested in a range of high-potential manufacturing companies over the years, from Uform and M Squared Lasers to Joloda Hydraroll and Croom Precision Medical. For entrepreneurs seeking to scale their companies in the manufacturing space, learn what ‘good’ looks like to our investors, and read their guidance for fundraising below.

The yin and yang of management teams

It’s important that the management team is a good working unit, made of complementary skillsets that work in balance with one another. Our investors like to see an ambitious CEO that wants to push the boundaries, but this approach may be most effective when there’s also a strong CFO to provide a dose of practical realism. That yin and yang often works well.

We’re also looking for a team that’s self-aware, curious about what they don’t know, and willing to receive input from other parties to help improve the business over the long run.

Whatever you do, do it extremely well

As a growing business, you don’t always need to have ground-breaking technology or products (although this is obviously great!). You might be a great manufacturing company that does run-of-the-mill stuff. But the key is to do it extremely well.

This means having streamlined and effective operations, with a focus on the basics that customers expect, but which many businesses fail to deliver. For example, high-quality products, reasonable lead times, and superb customer service.

In our portfolio, Decora is a great case study of a company in an established market segment (it manufactures blinds and window coverings) that stands out because its operations are so efficient and of such high quality.

Find yourself a big enough pool to grow in

The market your business operates in doesn’t need to be enormous, but it does need to be big enough to allow the company to reach its goals, without having to own the entire market. Some businesses do own the entirety of their market, but they are few and far between.

The exception to this is if a niche market is expected to grow fast. For example, we invested in raw pet food business Bella & Duke; the market for raw pet food isn’t huge, but we expect it to grow rapidly, and Bella & Duke is in a great position to benefit from that growth.

Do you have the potential to expand into new locations?

A lot of manufacturing businesses are limited by geography. If they manufacture something that’s very bulky or heavy, transportation restrictions may mean it doesn’t make economic sense to try to ship to distant territories. Where a business is able to have a presence in other geographies, however, then that will open its market and create opportunities.

If international growth is part your plans, you need to be able to demonstrate to an investor how your business will plug into new territories and what the supply chain setup will look like.

Multiple exit options

Unlike traditional private equity investors, we provide patient capital, without fixed exit deadlines. And it’s up to the businesses we back what route they want to go down, but it is reassuring to us – and, generally speaking, all shareholders – if we’re able to keep our options open, when it comes to exiting our investment in the future.

If there’s a track record of mergers and acquisitions (M&A) in the market, and we can see a pool of potential buyers for the business, that’s a big tick in the box for our investors. And if there are potential trade buyers, management buyout options, or the possibility of listing on a stock exchange, then that makes the business even more attractive to us.

Build a strong relationship with your investors

When looking to back a founder or management team, we don’t only consider their talents and skills. We also think carefully about whether we can build a relationship with them. Successfully scaling a business and creating value together can take time, and there will be plenty of bumps along the road. So, it’s vital that everyone involved enjoys the journey and has fun along the way. A strong relationship and alignment with your shareholders is key to achieving this and delivering the right outcome for everyone.

Meet our team

Paddy Graham heads up our investment team in Scotland and Northern Ireland. Here, he shares examples with us of the kind of manufacturing business he’s looking to back:

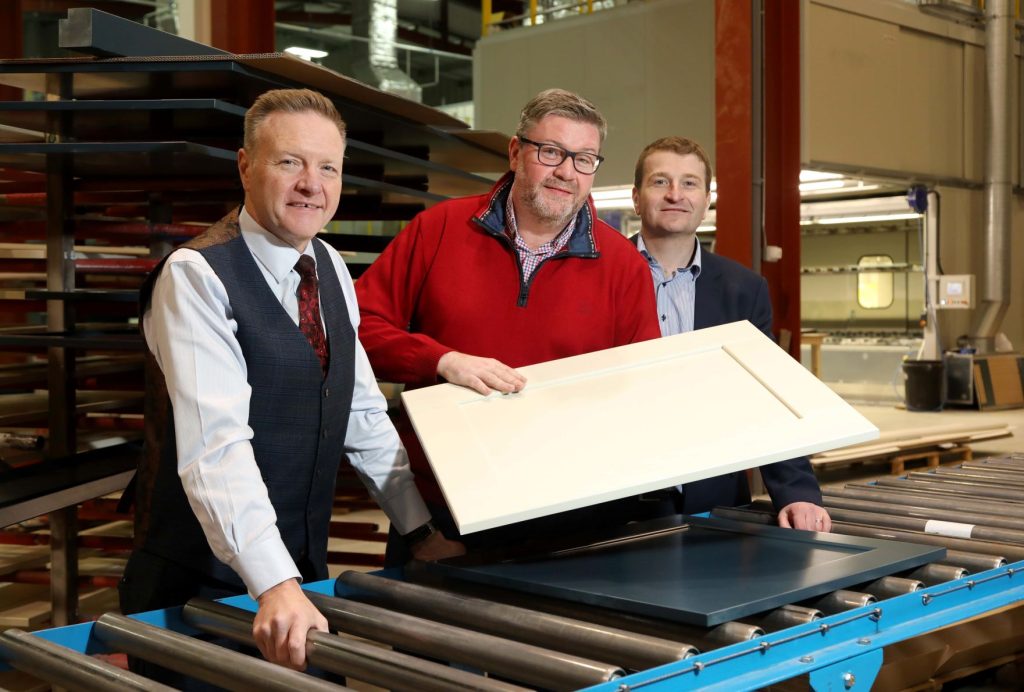

“I could point to any of BGF’s investments as great examples of the type of manufacturing company I’m after, but if I had to pick one, Stevenswood springs to mind. We backed a team of three individuals there, with complementary skillsets. They were experienced, open-minded, and great fun to work with. We built a wonderful relationship with the team, growing the business significantly, before it was ultimately sold to a trade buyer (although there were plenty of other exit options).

“The same individuals from Stevenswood came back to us a couple of years later, having started another manufacturing business — Window Supply Company — and we invested in them again. They have a great team, a strong relationship with us, and a real focus on getting the basics right. That was a compelling opportunity for everyone involved.