Value beyond investment

Learn how we could help accelerate your business growth

Could you benefit from growth capital and scaleup support from our team? Learn more about our approach to investing, our funding criteria and deal process.

Growth capital

If you’re considering fundraising for your business, you’ve likely thought about how much you want to raise, how much equity you’re willing to give up (if any), and the kind of backer you want on your cap table. Growth capital from BGF could be the right option, if you’re looking for:

- Minority equity investment (or a mix of equity and debt)

- Access to follow-on funding for new growth opportunities

- Patient capital, without fixed exit deadlines

- Expertise and support in scaling your business

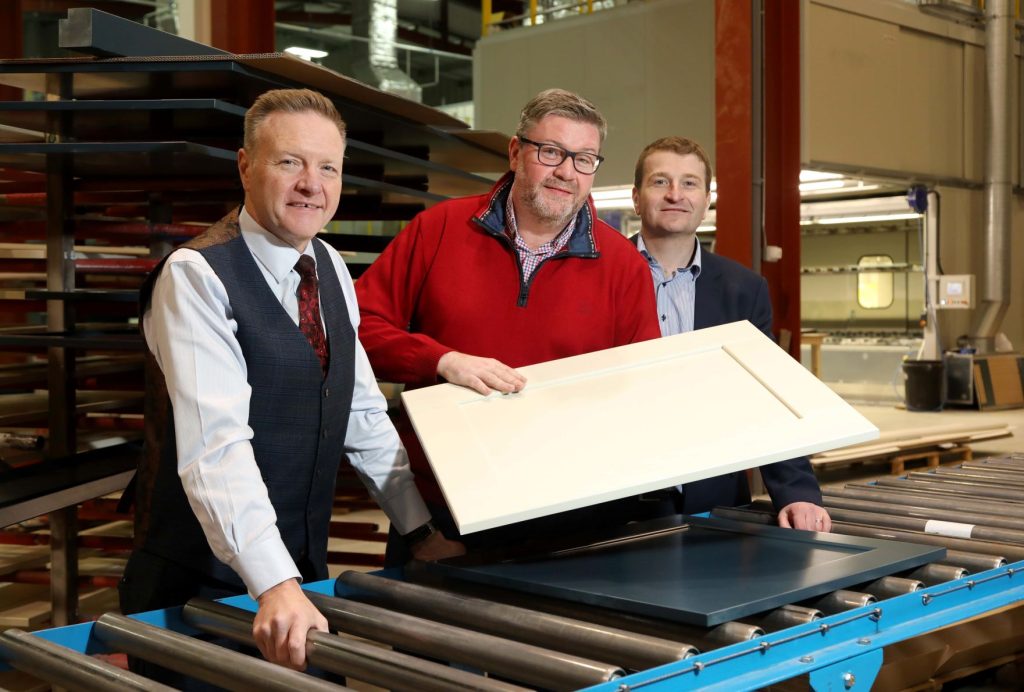

Value creation

Partnering with BGF is about more than funding. We could help unlock long-term value in your business, with experience across a wide range of growth strategies. We work closely with our portfolio, providing a full programme of support, designed specifically for growing companies, including:

- Talent mapping and search

- Access to new customers

- Board-level support

- Structured learning programmes

- Exit planning

- Founder and C-suite communities

Fundraising for the first time?

While bootstrapping a business can foster sharp focus and discipline, it often falls short of funding your growth strategy, and may not match the pace of new market opportunities. Raising external capital and seeking support from an investor like BGF could help you to:

- Accelerate your growth plans

- Unlock more value in your business

- Achieve a successful exit

Our funding criteria

We back ambitious, entrepreneurial businesses across the UK and Ireland, to help realise their potential.

Our Growth team looks for private SMEs matching this profile:

- Strong track record and growth strategy

- Typically £1m-£10m profit (or £3m+ ARR for tech)

- Not a financial institution

- Seeking initial investment of £3m-£30m from BGF

While our Early Stage team looks for startups that are:

- Late seed to series B

- Innovating in life sciences or deep tech

- IP-protected

- Seeking £3m-£10m investment from BGF (£5m-£30m total)

The deal process

Our initial investment process typically includes these key stages:

- Initial meeting and discussion on stakeholder objectives

- Information sharing around your business and growth plan

- Agreeing heads of terms (preliminary agreement outlining main commercial and legal terms of the deal)

- Third-party due diligence

- Deal completion

How to apply

Sound like a good fit? Complete our online form to introduce yourself to the team. We’ll ask you for contact details and some initial information about your business, such as:

- Company registration number

- Investment stage

- Current employee count and EBITDA

- How much you’re looking to raise

- Why you’re seeking funding

Our investment team will review your submission and get in touch if they need more information.

Stay in touch

Not ready to raise just yet? Want to be kept in the loop with our upcoming events, deal news and insights? Tell us a bit about yourself below.